My pervious post was about business scalability, a term used by Rakesh jhunjhunwala frequently. I attempted to lay out my understanding of the term in that post.

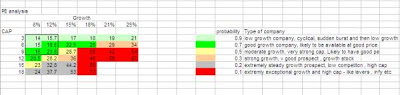

Business scalability is a critical factor in valuation. As I detailed on my post on intrinsic value, the DCF formulae can be used to calculate this number. There are two key variables in the formuale – Free cash flow and the duration of the same before the terminal value is applied. This duration also referred to as CAP (competitive advantage period) is the time period during which the company is able to earn above its cost of capital. Beyond this period the company earns its cost of capital and hence is valued at its terminal value.

A company with a scalable business will be able to grow its free cash flow faster (higher growth) and also have a higher CAP at the same time. Now higher the growth and CAP, higher is the intrinsic value. If you can identify such a company much before the market does, as Rakesh jhunjhunwala and other top investors are able to, then the returns are very very high.

However identifying such companies is not easy. The most common error I have seen with analysts is that they identify the market opportunity, pick a company most likely to do well and stop at that. The analysis should also involve analysing the business model in detail, identifying the key drivers of performance and doing an assessment of these drivers. If this sounds complicated, then it is. The value is not easily apparent and requires quite a bit of analysis and digging around. All this has to be done before the market recognizes the company and bids up the price.

I think this approach to investing is a very advanced form of investing. It is not easy for a novice investor to practise this form of investing easily. One should have a keen understanding of business models, valuations, economics and other aspects of investing. Graham or deep value investing requires much lesser expertise and also has more diversification of risk. However this form of investing, where an investor can correctly identify a scalable business, is the key to long term riches.