Read this new article on the global car industry on the economist. My take in terms of impact on the indian industry

– The weaking of the global companies like GM, Ford and their suppliers like Delphi etc would be a great positive for the indian auto parts industry as these companies would have to look at further cutting costs to survive. Indian auto part companies are very cost competitive and are rapidly moving up the value chain

– Critical factor for indian auto parts companies would be how rapidly they can scale up and meet the global quality and service standards ( provided they get some support on infrastrucutre ). Also they can avoid cost pressures if they develop the required technology and IP.

– Not been able to come to conclusion on it would impact the domestic car industry…will it be beneficial for maruti, Tata motors etc ??

Business model of Ratings agency – Crisil

I am looking at the financial numbers of crisil. My thinking was that CRISIL and any other rating agency would have a good business model. On looking at the numbers i have been completely blown away.

– Return on networth – 20 % +

– Return on capital employed in business – 80 % (approximate ). The company has about Rs100/share of investment

– Net profit is almost equal to cash flow as a rating agency would not have too much fixed expenses (other than offices which can be bought or leased)

– Not much of working capital requirement (close to zero)

– Net margins of 20% +

– Strong competitive advantage in the form of a strong brand name ( CRISIL or ICRA etc ). Any company wanting to get rated will have to go to these companies …sometimes to all of them ( and i cant think of new companies being able to get into this business easily)

– additional lines of business through these relationships with companies like advisory services, research services etc which provides additional revenue streams.

So if everything is so good , why not buy the stock …?? looked at the price and ofcourse the market is smart enough to recognise a good business. The stock sells at a PE of around 35. So it seems to be a great business available at not a great price. I will give it a pass ..but will continue studying the business model

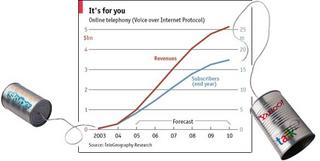

How VOIP would impact the Telecom industry

Read this article on how VOIP is impacting the telecom companies (or could impact). The article focuses on the number of users switching to VOIP and that the traditional companies could see a fall of upto 25 % revenue in the next few years.

I think VOIP could be the disruptive technology often referred to by Clayton M. Christensen in his book ‘the innovator’s dilemma’ . This technology although just below the required performance levels of the regular telecom market is fast improving and moving into the rapid adoption phase. Now with microsoft, skype and google behind it , it should not be long before more rapid adoption happens.

all of the above should be great for the consumer, but what will happen to the telecom industry …i would guess that their entire business model could get disrupted in the next few years …what does this mean for companies like VSNL, bharti or reliance infocomm ?

some of them could face pain but would evolve with the new technology like reliance or bharti ..but i would not be too optimisitic for VSNL, MTNL and some others

i would be wary of investing in the telecom sector for a long term basis

Is it worth investing in the Oil sector

The goverment by controlling the prices is driving the sector to bankruptcy. Trying all kinds of permutations to keep the companies from going bankrupt (see article below). If the oil companies cannot charge market rate (shareholders subsidizing the customer ???!!) , then how is the sector going to make money.

I am still not able to get it (maybe i am missing something ). If the government ( the majority shareholder ) controls the pricing (and profit) of the oil companies at the expense of the minority shareholder with no concern other than the political impact, what is the value of these companies ? how does one value such companies where the future cash flow in addition to being dependent on a volatile oil market is also dependent on a whimsical majority shareholder which has a non economic agenda ! . This sector would start looking like indian railways if the oil prices remain high (which looks likely), that is chronically sick

typically oil companies make good profits through forward contracts, hedging etc during rising oil prices (more so if they are vertically integrated). But the indian oil companies are actually down when the overall market is up ( see chart )

To provide cushion for under-recoveries — Standalone refineries may be merged with oil marketing cos — From hindu business line

Our Bureau

New Delhi , Aug. 17

THE Ministry of Petroleum & Natural Gas is weighing the option of merging pure refining companies with oil marketing companies (OMCs) to enable the latter to cushion the impact of high global crude oil prices on their bottomline.

Due to the freeze by the Government on raising retail prices despite the rise in raw material cost, the fuel retailing business is seen as becoming economically unviable, resulting in OMCs such as Indian Oil Corporation, Bharat Petroleum Corporation, Hindustan Petroleum Corporation and IBP suffering losses.

However, standalone refiners in Chennai, Kochi and Mangalore are making profits as they get the international price for the fuel they produce.

Asked whether the Petroleum Ministry was contemplating such a move, the Petroleum Secretary, Mr S.C. Tripathi, told Business Line that, “various options are being considered. In view of the high crude oil price scenario, some serious structural changes could be made in the downstream sector.”

About the suggestion made by the Committee on Synergy in Energy to oil companies asking them to consolidate their businesses, the Secretary said, “we are keeping that also in view.”

Explaining the rationale behind such a consideration, a Petroleum Ministry official said standalone refiners were currently earning huge margins, while the OMCs were taking a hit. The merger could help in sharing refining margins with OMCs. “But this is a long-term view and may take some time,” he said.

Meanwhile, the bleeding OMCs have been seeking a revision in the prices of the four petroleum products – kerosene, LPG, petrol and diesel.

The companies have incurred a cash loss of Rs 1,516 crore in July. They have sought Rs 5.29 per litre increase in petrol and Rs 4.54 a litre hike in diesel prices. Indications are that the Government is unlikely to consider the price revision before the end of the current session of Parliament.

Also, negotiations were on with the Finance Ministry to consider an excise duty cut, senior officials said.

The Government may consider a hike between Rs 1 and 2 per litre each combined with excise duty reduction on petrol from 8 per cent plus Rs 13 a litre to 8 per cent plus Rs 12 a litre and that on diesel from 8 per cent plus Rs 3.25 a litre to 8 per cent plus Rs 2.25 per litre.

Hotel stocks – some number

Pulled out these number from the equityresearchindia website. Pretty depressing economics ….guess one can make money on one can catch the inflexion point when the economy is turning and the hotel industry is poised to do well …

2005 2004 2003 2002 2001 2000 1999

A) Return on Equity (i x ii) 9.20% 4.40% 3.20% 4.40% 8.90% 9.50% 11.90%

i) Return on Total Assets

4.70% 2.10% 1.60% 2.40% 5.20% 5.90% 7.90%

ii) Total Assets To Total Equity

2 2.1 2 1.8 1.7 1.6 1.5

B) Return on Total Assets (iii x iv) 4.70% 2.10% 1.60% 2.40% 5.20% 5.90% 7.90%

iii) Net Profit Margin

11.10% 6.60% 5.60% 8.20% 13.90% 15.40% 17.20%

iv) Total Assets Turnover

0.4 0.3 0.3 0.3 0.4 0.4 0.5

C) Total Assets Turnover (v / vi) 0.4 0.3 0.3 0.3 0.4 0.4 0.5

v) Total Income (Rs. Cr.)

3103 2452 2052 1924 2241 2012 2078

vi) Average Total Assets (Rs. Cr.)

7374 7597 7023 6577 5959 5260 4495

Hotel stocks

Was looking at the latest results of the hotel industry. The headlines are screaming about the triple digit growths and the tight demand supply situation. The rise in tourist inflows / good business climate are being cited as the reason for the optimism.

I am not too excited by the results or by the economics of the hotel industry. It is typical commodity industry. Some companies have good brand names, but do they have a strong franchise. What i mean by that is, can these companies charge a premium price? . Taj and others can charge a premium compared to the other hotels, but when there is excess supply, the typical occupancy rates and ARR (average room rents) suffer. During such period the margins drop and due to the high fixed costs , even the best of the companies can barely remain in black.

So over a complete business cycle most of the companies in this sector can barely cover their cost of capital. The asset turnover ratios are very low and so to earn a return over their cost of capital, most of these hotels need to maintain a Net profit margin in excess of 10 % ( a tall task when times are bad).

On the contrary this industry looks almost like the steel, cement and the other commodity industry, where only a low cost producer like gujarat ambuja or Tata steel can be profitable over the long term. Can’t think of any such hotel company …

Compare this with the FMCG/Pharma/IT and most of these companies even during a downturn, earn over their cost of capital.

As a side note, ITC seems to be investing their cash flows from ciggarette business to hotels, Paper and FMCG which are businesses with poor economics. Granted , that the company is getting growth, but is it profitable ( doesnt seem to be as of now)?

Analysing the auto component industry

I have been studying the Indian auto component industry for the last few days. The industry appears to have a good future ahead (whether there are some good stocks at good valuation is something i need to check).

The auto industry has two main channel – OEM and After sales. The industry has been restricted mainly to the domestic industry in the past and was thus tied to the fortune of the domestic auto industry (which in turn is cyclical).

A few changes have happened which have opened up the export market to this industry

– Recognition of India for its technical manpower. This is crucial especially in auto which involves a lot of R&D and design for new components at the higher end of the value chain

– Low cost labor

– Opening up of the Auto sector by the Indian government, due to which the global majors such as ford, GM etc setup shop in India and started sourcing from local suppliers. This helped in improving the competitiveness of the Indian auto component makers

– increase in scale of the domestic auto component makers and foray into the export market

Industry landscape

Some of the key firms in the industry in terms of their size are

– Bharat forge

– MICO

– Motherson Sumi

– Exide

– Sundaram fastners

Porter’s 5 factor analysis

Barriers to entry

– Technology: several auto components have a high technology component and can be produced by only those companies which have access to the technology or have developed it themselves. As a result most of the auto makers specialize in specific components

– Economies of scale

– Brand is crucial, more so in the Spares market (and as a result a distribution network too)

– Customer relationship in the form of long term contracts

Rivalry among firms

Rivalry among firms would be high in Spares market, but lesser in the export markets wherein the norm is long term contract. In addition the industry has high technology component and hence the industry does not deal in completely commodity product. However competition could be from other firms from other countries in a similar product line

Supplier power should be low as the key raw material is steel which in itself is a commodity

Buyer power is high especially for the OEM market and with high competition between auto makers there should be a constant pricing pressure on the auto component makers going forward

I would consider the threat of substitute product as low

The key success factors for the industry going forward should

– Continued investment into technology/ process to build barriers to competition and provide a cost and quality advantage to the customer

– Pursuit of economies of scale to be cost competitive. It should be in both production and in R&D

– Developing strong customer relationship through quality and reliable supply

Key risks

– Pricing would remain under pressure going forward

– Inability to meet the supply schedules of the customer

– Development of alternative outsourcing locations

The industry is into a growth phase. However the market also seems to have recognized that and most of the companies seem to be fairly valued.

Evaluating the cement industry – porter’s model

I have been trying to assess the cement industry on the five factor model and have been able to come to the following evaluation

Entry barrier – Entry barriers are not too high in the industry. The technology is easily available. The only constraint is capital which a big player will have access to. The key barriers would be

– economies of scale which would favor the bigger players like Birla group or Gujarat ambuja

– Brands are not so critical. price plays a big factor

– Cost advantage is critical. Companies which can have a sustainable low cost position will have a competitive advantage. The major players in India do seem to have a similar cost position. Gujarat ambuja has been able to sustain a low cost position and has been able to reward shareholders.

Supplier power – Has very low impact. Mainly limited to coal / power wherein the government pricing would have an impact. But this would be common to all companies

Buyer power – Very low to no impact

substitute product – Almost no substitute product

Rivalry – High rivalry in the industry as the industry is still fragmented. Top 6 players have 60 % capacity as there has been consolidation recently. however local players can have an impact on pricing as cement as the industry depends on local supply. Cement being bulky is generally not transported from long distance

In summary due to low brand strength, high fragmentation, low cost advantages (except in case of some players ), the competitive intensity is high. Pricing is poor and depends on demand scenario. If demand drops , the profitability suffers as the players cut price to run plants at full capacity (due to high fixed costs).

Not an ideal industry for long term investment ( except if one can find a player with a sustainable low cost position )

Dollar depreciation will stress test the Indian offshore model

Most of the Indian IT/ ITES companies have good margins and high return on capital. They quote a fairly high PE’s.

If the reports are to be believed, a dollar depreciation is a high probability event. When will it happen and whether it would be rapid or slow and measured is the question. Most of the economist / financial commentators agree that dollar has only one direction to go in the long run and that is down. Now even the asian central bankers who are biggest buyers of US treasury seem to be acting on that.

Estimates show that a +1% appreciation of dollar would cause the margins to drop by 0.5 % ( or more …i don’t have the exact number ).

So hypothetically speaking if the appreciation is 10 % ( a probable outcome ) , then margins could drop by 5 – 10 %. Add to that wage inflation in india and increased competition , the Offshore business would come under severe stress.

This is not to say that the offshore trend will stop or the companies will go bankrupt or something, rather indian companies will have to learn to live with lower margins

This could see some weak companies getting washed out and the current darling could see their high multiples which the stock market gives them, being reduced.

So add a reduction in margins and drop in multiples and that gives you a picture of what could happen to the stock price.

analysing an IT services company stock

The IT service industry in india is currently getting high valuations and seems to have a very bright future . The typical PE are in a range of 40 + for the tier one companies.

The key point to understand is that the future of an good company can differ from the future of the stock. A company like infosys grew by 30-40 % from 2000 onwards. However the stock has gone from 10000 to 8000 (pre split ).

The future of IT companies definitely looks bright . The factors are fairly obvious and well know like trend towards offshoring , india’s IT manpower, cost differentials etc etc etc.

The problem is that all these factors are known by everyone and seems to be priced into the stocks. The tier IT companies sport PE’s of 40 +.

what does that translate in terms of market expectations . to put it briefly –

a) maintenance of the high Return on capital for the foreseeable future ( 5 years + )

b) Maintenance of the high margins / low capital requirements

c) moderate to high growth rates

d) Low probability of a shift in the basic business model / economics of the business

As long as the above expectations are met or exceeded , the stock should do ok or better. All of us can have differing opinions on each of the above factors . Whether right or wrong , only time will tell. But it pays to understand the underlying risks to each of the factors.

point a and point b are related. High returns over very long time is possible only if the companies have a very strong and sustainable competitive advantage. Do indian companies have that or are into labor arbitrage ? I would belive more of the latter (labor arbitrage ) than anything else. But to be fair they are trying hard to move away. If they do not succeed (having a sustainable competitve advantage is difficult in service business ) then the return / margins will go down.Also dollar – Re rate will have a negative impact on the two point if the dollar drops against the rupee ( a high possibility in the long run )

point c – Very likely high growth will continue for some time.

Point d – The current model itself is disruptive and may play out for some time . But in technology one can never be sure how things will be over 4-5 years. The concern is less if china or any other company becomes an alternative destination to india. Indian companies will expand to those location and use it to their advantage (already happening ). The bigger concern is what will be the business model 5 years hence. Will IT services still be required in the current form. Will technology replace a lot of work being done manually . This is hapenning already in voice activated system . So we can never be sure .And considering the amount of reasearch and innovation, it is quite likely to happen.

So it boils down to this : any one buying the stock is betting on the long profitability ( and not business alone ) of the IT services business in the current form ( high margins , high return on capital ). If one can be confident that it will continue for the next 10 years , then one will make money and deserves to for his / her foresight. Else you are following the herd and can lose money