A new website from SEBI and ministry of company affairs which lists any non complaince or any voilation of guidelines or rules by people associated with any public listed companies. Great step towards transparency and investor eductation !!

watchoutinvestors.com is a national web-based registry covering entities including companies and intermediaries and, wherever available the persons associated with such entities, who have been indicted for an economic default and/or for non-compliance of laws/guidelines and/or who are no longer in the specified activity. This information which is presently disorganized, difficult-to-use and is spread across a large number of sources i.e. websites, databases, publications, notifications and orders of the government and of other organizations, agencies, courts of law, tribunals and commissions, has been aggregated, indexed, standardised ,reformatted and re-presented in a form and manner that can be accessed in a user friendly manner.

Blogging for dollar – A new business model for individuals ?

Came across this blog from darren. He seems to have made 100000 usd via blogging in the last 1 year. Seems to be an interesting business model. Can this become a full time source of income ? i dont think so ( and darren suggests the same).

But i think blogs can be become a powerful tool for small time entreprenuers and a creative outlet for a lot of people. In addition a lot of companies can use blogs for internal and external communication (with customers ). Microsoft seems to be doing so.

We may see some companies use blogs in addition to their website to get closer to their customer (experience marketing ?)

It would interesting to see how this medium develop. But it would be safe to say a handful will achieve prominence ( the ones which will pass the tipping point ??) , whereas the rest would remain a labor of love (or pain if you are in it for the money only )

there is an interesting post i read on mark cuban’s blog on a similar topic – podcasting

Good articles on value investing

Mr Sanjay bakshi is a visiting professor at Management Development Institute, Gurgaon, India. He has a blog – http://www.fundoo_professor.blogspot.com/ and a website http://www.sanjbak.com/ .

He is also the CEO of Tactica Capital Management, an investment boutique. There some very good articles on his website which really worth reading

Reading a book on Bill miller

I have been reading a book on bill miller from janet lowe

A few things which I learnt

– It is critical to develop a multi-disciplinary model to evaluate companies. This is getting more important as new companies would have more intangible assets than tangible ones and would depend on network effects / customer lock-in etc to create value (like e-bay). even old economy companies will have some component of new economy companies (think about the website of most retailers )

– Importance of understanding business models of these new economy companies and avoiding slotting them into incorrect categories. Bill miller gives an example of amazon.com which is looked at as a retailer and as a result the market has got it wrong several times. According to miller, business model of amazon is closer to dell than walmart (although amazon is using the same wallmart strategy , but online – keep the gross margins constant and pass the benefits to the consumer to build scale )

– The market typically makes an error in evaluating a new business model and is slow to recognize it (but eventually it does). So an investor like miller who has the foresight , can beat the market on these companies (examples given were for dell and amazon )

– Concepts such as network effects, customer lock-in and increasing returns have been discussed briefly in the book with some example.

– Some example of companies which have both new and old economy models

– The book brings out bill miller’s capability to think independently and stand against the crowd ( there is an incident narrated in the book , where it seems in the baron’s panel , one of member asked if bill was drunk when he bought amazon in 2001 – eventually bill was vindicated on his decision

One the most important points which I learnt from the book was to develop an open mind on the new concepts which are coming up and the way they are being used by value investors like bill miller. The growth v/s value tag seems to be immaterial for any company as long as one can assess the intrinsic value of a company and buy it at a discount. Although I may find it difficult to apply these concepts directly, I think these new concepts would help me analyzing and appreciating the new business models which are developing

If the market is falling ..why am i smiling ?

for the same reason, when the price of a computer, telecom charges, or any other stuff which i need to buy falls !!

It allows me to buy more of it ….

The above way of thinking is ofcourse not original …kind of learnt it from warren buffett. But having internalised it, it makes a lot of sense

so every day when the market falls , i smile and hope that the stocks which i am wanting to buy and have not been able to, would be available soon at a good price

Is it worth investing in the Oil sector

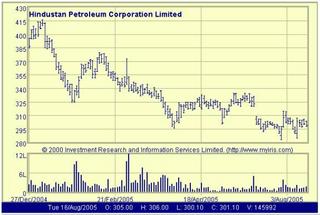

The goverment by controlling the prices is driving the sector to bankruptcy. Trying all kinds of permutations to keep the companies from going bankrupt (see article below). If the oil companies cannot charge market rate (shareholders subsidizing the customer ???!!) , then how is the sector going to make money.

I am still not able to get it (maybe i am missing something ). If the government ( the majority shareholder ) controls the pricing (and profit) of the oil companies at the expense of the minority shareholder with no concern other than the political impact, what is the value of these companies ? how does one value such companies where the future cash flow in addition to being dependent on a volatile oil market is also dependent on a whimsical majority shareholder which has a non economic agenda ! . This sector would start looking like indian railways if the oil prices remain high (which looks likely), that is chronically sick

typically oil companies make good profits through forward contracts, hedging etc during rising oil prices (more so if they are vertically integrated). But the indian oil companies are actually down when the overall market is up ( see chart )

To provide cushion for under-recoveries — Standalone refineries may be merged with oil marketing cos — From hindu business line

Our Bureau

New Delhi , Aug. 17

THE Ministry of Petroleum & Natural Gas is weighing the option of merging pure refining companies with oil marketing companies (OMCs) to enable the latter to cushion the impact of high global crude oil prices on their bottomline.

Due to the freeze by the Government on raising retail prices despite the rise in raw material cost, the fuel retailing business is seen as becoming economically unviable, resulting in OMCs such as Indian Oil Corporation, Bharat Petroleum Corporation, Hindustan Petroleum Corporation and IBP suffering losses.

However, standalone refiners in Chennai, Kochi and Mangalore are making profits as they get the international price for the fuel they produce.

Asked whether the Petroleum Ministry was contemplating such a move, the Petroleum Secretary, Mr S.C. Tripathi, told Business Line that, “various options are being considered. In view of the high crude oil price scenario, some serious structural changes could be made in the downstream sector.”

About the suggestion made by the Committee on Synergy in Energy to oil companies asking them to consolidate their businesses, the Secretary said, “we are keeping that also in view.”

Explaining the rationale behind such a consideration, a Petroleum Ministry official said standalone refiners were currently earning huge margins, while the OMCs were taking a hit. The merger could help in sharing refining margins with OMCs. “But this is a long-term view and may take some time,” he said.

Meanwhile, the bleeding OMCs have been seeking a revision in the prices of the four petroleum products – kerosene, LPG, petrol and diesel.

The companies have incurred a cash loss of Rs 1,516 crore in July. They have sought Rs 5.29 per litre increase in petrol and Rs 4.54 a litre hike in diesel prices. Indications are that the Government is unlikely to consider the price revision before the end of the current session of Parliament.

Also, negotiations were on with the Finance Ministry to consider an excise duty cut, senior officials said.

The Government may consider a hike between Rs 1 and 2 per litre each combined with excise duty reduction on petrol from 8 per cent plus Rs 13 a litre to 8 per cent plus Rs 12 a litre and that on diesel from 8 per cent plus Rs 3.25 a litre to 8 per cent plus Rs 2.25 per litre.

Hotel stocks – some number

Pulled out these number from the equityresearchindia website. Pretty depressing economics ….guess one can make money on one can catch the inflexion point when the economy is turning and the hotel industry is poised to do well …

2005 2004 2003 2002 2001 2000 1999

A) Return on Equity (i x ii) 9.20% 4.40% 3.20% 4.40% 8.90% 9.50% 11.90%

i) Return on Total Assets

4.70% 2.10% 1.60% 2.40% 5.20% 5.90% 7.90%

ii) Total Assets To Total Equity

2 2.1 2 1.8 1.7 1.6 1.5

B) Return on Total Assets (iii x iv) 4.70% 2.10% 1.60% 2.40% 5.20% 5.90% 7.90%

iii) Net Profit Margin

11.10% 6.60% 5.60% 8.20% 13.90% 15.40% 17.20%

iv) Total Assets Turnover

0.4 0.3 0.3 0.3 0.4 0.4 0.5

C) Total Assets Turnover (v / vi) 0.4 0.3 0.3 0.3 0.4 0.4 0.5

v) Total Income (Rs. Cr.)

3103 2452 2052 1924 2241 2012 2078

vi) Average Total Assets (Rs. Cr.)

7374 7597 7023 6577 5959 5260 4495

Hotel stocks

Was looking at the latest results of the hotel industry. The headlines are screaming about the triple digit growths and the tight demand supply situation. The rise in tourist inflows / good business climate are being cited as the reason for the optimism.

I am not too excited by the results or by the economics of the hotel industry. It is typical commodity industry. Some companies have good brand names, but do they have a strong franchise. What i mean by that is, can these companies charge a premium price? . Taj and others can charge a premium compared to the other hotels, but when there is excess supply, the typical occupancy rates and ARR (average room rents) suffer. During such period the margins drop and due to the high fixed costs , even the best of the companies can barely remain in black.

So over a complete business cycle most of the companies in this sector can barely cover their cost of capital. The asset turnover ratios are very low and so to earn a return over their cost of capital, most of these hotels need to maintain a Net profit margin in excess of 10 % ( a tall task when times are bad).

On the contrary this industry looks almost like the steel, cement and the other commodity industry, where only a low cost producer like gujarat ambuja or Tata steel can be profitable over the long term. Can’t think of any such hotel company …

Compare this with the FMCG/Pharma/IT and most of these companies even during a downturn, earn over their cost of capital.

As a side note, ITC seems to be investing their cash flows from ciggarette business to hotels, Paper and FMCG which are businesses with poor economics. Granted , that the company is getting growth, but is it profitable ( doesnt seem to be as of now)?

Added two blogs

I have added two blogs which i frequently read . One is mark cuban’s blog and the other Victor Niederhoffer

Mark’s biography is below

http://www.nba.com/mavericks/news/cuban_bio000329.html

and victor’s is below

http://www.dailyspeculations.com/aboutus.htm

Both write excellent and thought provoking blogs

Competition

Found this posting Victor Niederhoffer’s blog on competition. I agree competition is good for society / consumer , but bad for an investor. I would prefer a company which is close to a unregulated monopoly ( a toll bridge as buffett says )

Competition, by Victor Niederhoffer:

Competition in its many aspects — markets, trees, companies, old heartedness, protection of consumers, romance — is the main force responsible for our high standard of living. It brings out the best in us and provides the consumer with the price and quality he wants. James Lorie, along with Franklin Fisher, was one of the chief consultants for IBM in the antitrust action against it in the 1970s. I came across this quote by Fisher vis a vis the similarities to the Microsoft case:

Every practice that the government complained of had to due basically with the offering of better products or lower prices. The government did not understand that that is the way competition works.

He then goes on to show how IBM had developed a better and smaller disk and the government complained it was a predatory device.

If only the public were educated to realize that there is always someone waiting around to provide a product at a more attractive price or quality or time or convenience, then so much wasted envy and loss would be averted.