P&G Hygiene just declared great results. I have always liked their business (I used to work in the FMCG industry and have seen their sales organisation closely). The topline growth is encouraging with good growth in the Vicks and Feminine hygiene categories.

As expected, cash flow from business is very good as the expense on the main asset – brands , is expensed through advertising. Fixed asset / Wcap requirements are low ( and asset are being worked more through contract manufacturing for the parent company ). The company has been declaring good dividends for quite some time.

The companies has a very clean balance sheet , just 80 cr worth of Fixed asset and 165 odd cr of WCAP (228 crs being cash , effectively meaning -ve working capital ) for generating almost 500 cr + net income. Net margins are in 15 % range ( compared to 7-9 % for the FMCG industry ). This shows that the company has good pricing power and sustainable competitive advantage and a very lean balance sheet.

The stock is pricey though, selling at a PE of about 30. I have looked at the company in the past but never bought it as it was not comfortable with the management. P&G global has opened a subsidiary which is not listed. P&G hygiene pays royalty to the parent ( whereas the indian shareholder pays for the advertising and brand building ). In addition all new brands are being introduced through the 100 % owned subsidiary.

Difficult to trust the management to be fair to the indian shareholder …they could pull a fast one like the other MNC of taking the company private and leaving the indian minorty shareholders in a lurch. Maybe i am being paranoid , but then there a lot of other companies to invest , so why take chances ..

A good article on the global car industry

Read this new article on the global car industry on the economist. My take in terms of impact on the indian industry

– The weaking of the global companies like GM, Ford and their suppliers like Delphi etc would be a great positive for the indian auto parts industry as these companies would have to look at further cutting costs to survive. Indian auto part companies are very cost competitive and are rapidly moving up the value chain

– Critical factor for indian auto parts companies would be how rapidly they can scale up and meet the global quality and service standards ( provided they get some support on infrastrucutre ). Also they can avoid cost pressures if they develop the required technology and IP.

– Not been able to come to conclusion on it would impact the domestic car industry…will it be beneficial for maruti, Tata motors etc ??

Is the market overvalued ?

I have been reading a lot of analysis on the market valuation levels. A few articles are citing that at a PE of 14 – 15 the market is not too overvalued and should give good returns.

On the other hand , some statistics show that market is fairly or overvalued as the ROE for the indian industry is at its peak, Interest rates low, inflation low and the demand robust. As a result we are seeing these PE levels which are at the peak of a cycle and the normalised PE should be close to 17-18.

I find both arguments plausible, but my money is on the overvaluation side. I have become fairly cautious for some time and would be looking at initiating selling if the markets keep rising.

Also the overall market valuations are important if one is invested in index funds or ETF’s. Otherwise rather than concentrating on the market, i am looking at my individual holdings and would start reducing them if they start getting more overvalued (i think some are fairly close to their overvaluation levels)

Although i am not invested in commodity companies, i would look at their valuation levels more closely and would even look at selling them as my thought process is that commodity cycle is at a peak and industry profits are at a cyclical peak (for steel, cement etc ) due to robust demand, high capacity utilisation, low debt and interest level. PE for these companies is very low and i would not base my evaluation on those PE as the earnings are at a cyclical peak. In addition a lot of capacity addition is starting now, for ex: Tata steel seems to have announced a huge capex plan. So i would be wary of putting any money or holding onto commodity companies

Any thoughts ? please share with me

A New Blog

I have added a new blog by Prof Sanjay bakshi . Should be interesting to read his comments / articles and analysis

Business model of Ratings agency – Crisil

I am looking at the financial numbers of crisil. My thinking was that CRISIL and any other rating agency would have a good business model. On looking at the numbers i have been completely blown away.

– Return on networth – 20 % +

– Return on capital employed in business – 80 % (approximate ). The company has about Rs100/share of investment

– Net profit is almost equal to cash flow as a rating agency would not have too much fixed expenses (other than offices which can be bought or leased)

– Not much of working capital requirement (close to zero)

– Net margins of 20% +

– Strong competitive advantage in the form of a strong brand name ( CRISIL or ICRA etc ). Any company wanting to get rated will have to go to these companies …sometimes to all of them ( and i cant think of new companies being able to get into this business easily)

– additional lines of business through these relationships with companies like advisory services, research services etc which provides additional revenue streams.

So if everything is so good , why not buy the stock …?? looked at the price and ofcourse the market is smart enough to recognise a good business. The stock sells at a PE of around 35. So it seems to be a great business available at not a great price. I will give it a pass ..but will continue studying the business model

Impact of High petrol prices

Have been thinking of how higher petrol prices would affect indian industry. My opinion is that companies like FMCG / IT services / Telecom should not effected much , either due to their inherent pricing ability or because fuel costs are low for them and affect them only indirectly.

The above event should impact oil companies postively ( hopefully they will not go bankrupt). Commodity businesses may get impacted badly if the demand falters and the costs go up. Metals/ Cement / Steel etc could get impacted negatively.

Cant think of the impact on retail / Media and other such industries. They would have some second or third order impact ( less disposable income leading to lower demand ? ) …

I think the bigger impact could be on inflation and interest rates. I would stay away from fixed income funds for some time atleast. Also individuals with variable rate loans could be impacted. Will it impact the housing market …not really sure about it

Pricing strenght – A key indicator of competitive advantage

I was reading an interview of warren buffett a few days back. He was asked on what kind of businesses he prefers. His replied the ones where he can increase the price of the product ahead of inflation (he gave the example of see’s candies ). He also noted that one should avoid businesses where one has to pray before increasing the price by one cent (he gave the example of berskhire hathway – the textile company where they found it diffcult to increase prices )

The above comment got me thinking. Pricing strength of a business is a very powerful indicator of competitive advantage enjoyed by the business. Think of FMCG companies like HLL, P&G, marico . These companies have been able to increase their prices (although that ability has come down in recent past due to higher competition ). On the other end companies like steel , cement typically can increase prices only when there is supply shortage (which is only for a limited period of time)

I have found the above way of looking at a business a very powerful tool of checking if a business has enduring competitive advantage.

How about telecom companies or IT services companies …their pricing ability does throws up interesting insights ..although i have not been able to come to a conclusion

How VOIP would impact the Telecom industry

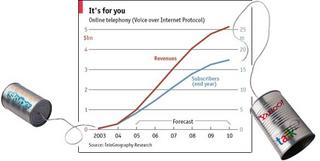

Read this article on how VOIP is impacting the telecom companies (or could impact). The article focuses on the number of users switching to VOIP and that the traditional companies could see a fall of upto 25 % revenue in the next few years.

I think VOIP could be the disruptive technology often referred to by Clayton M. Christensen in his book ‘the innovator’s dilemma’ . This technology although just below the required performance levels of the regular telecom market is fast improving and moving into the rapid adoption phase. Now with microsoft, skype and google behind it , it should not be long before more rapid adoption happens.

all of the above should be great for the consumer, but what will happen to the telecom industry …i would guess that their entire business model could get disrupted in the next few years …what does this mean for companies like VSNL, bharti or reliance infocomm ?

some of them could face pain but would evolve with the new technology like reliance or bharti ..but i would not be too optimisitic for VSNL, MTNL and some others

i would be wary of investing in the telecom sector for a long term basis

Kothari products ltd – A Net cash graham situation

I was running my screen in the year 2003 and came across kothari products. This was a company with 240 crs cash and equivalent (net of debt) on the balance sheet with a market cap of 80 crs ( i think they had 40 mn outstanding shares @ 170 rs / share). They currently have almost 300 crs (around 600 rs per share )

They were fairly profitable (although the profits were down). The market had beaten down the price due to legislation issues (The maharashtra government had banned Pan masala / gutka – their main products). The company was still profitable, although the profits had come down due to drop in sales. Its free cash flow is same as its net profit because Gutka and other tobacco products require little capex for plant and machinery or working capital. The main asset is the brand (in this case pan parag ). So their profits were pure cash for the owners

I bought the share at an price of Rs 160 – 170 a share and sold around 260 per share. The reason I sold was lack of information from the company ( their website is poorly updated in terms of financial results). In addition, I was not sure what the promoters were planning to do with the cash ( the promoters hold almost 70 % of the company).

So what’s the point of the whole thing …Its not that it was a profitable investment. Rather, although I made money on the whole thing, I did not have a very comfortable feeling with the investment. If I compare it with the other purchases I have done such as asian paints, or a concor which are good businesses with good management, this one made me uncomfortable as there was no transparency from the company. In the end I decided to get out rather than face an unpleasant surprise from the management.

My investment philosophy is closer to that of buffet where I end up buying good to great companies at fair prices and get a good night’s sleep. The above was an experiment in a graham style investment. It was profitable and based on a sound approach. But somehow requires more diversification and purchase in not so great enterprises.

Do you have a similar experience? please feel free to share with me

A great talk on value investing from Prof. Bakshi

I visit prof. bakshi’s blog regularly. He just posted a talk he gave on valueinvesting at the oxford bookstore in 2002. Great presenation with examples which have done well in the last 3 years. One can learn a lot on valueinvesting (and more in an indian context) from him and his posts.