Read this article on cnet.com. The article talks of the challenge which google is posing to Microsoft.

Found the following comment interesting. Interesting to see how established business models are getting disrupted constantly , for ex in Telecom, in the desktop space (where Microsoft had a complete monopoly).

Microsoft, it seems, is faced with a classic “innovator’s dilemma,” as author Clayton Christensen put it in his groundbreaking book that defined why tech giants usually miss the next wave of innovation. Microsoft execs made what looked like the right decisions at the time. As a result, the cash came in. The core product, Windows, became bigger and more complicated, and getting updated versions became harder to get out the door.

Plotting the counter-offensiveThe burden of that success, as the theory in the book goes, makes it harder to respond to the next generation of tech innovators. Years ago, Microsoft and Apple rattled IBM. Now Google, some believe, has a chance to rattle Microsoft by providing a cheaper, easier-to-use alternative. “Every other time Microsoft was attacking from below,” said one former executive. “Now (Microsoft) is being attacked from below and they don’t know how to deal with it.”

Can’t think of an equivalent scenario in India. But models which are undergoing a lot of change are retail, the auto industry – auto parts, Pharma industry (we seem to be playing a role in impacting the global industry ). Good to realize that in most of these sectors, Indian companies are acting as the disrupters or would be disrupters.

Am I too pessimistic about the market

I have been asking this question time and again to myself . Am I being too pessimistic ? I have some statistic below which I calculate to see how the over all market is looking like in terms of valuation and fundamentals ( extending back to 1991) Return on capital, earnings growth seems to be at an all time high. The earnings have more or less doubled in the last 2 years. As a result the valuation do not seem to be stretched. The market is definitely not as richly valued as 2000 or 1992-93. At the same time the earnings growth , return on capital and interest rates are much lower than what we had at that point of time.

Return on capital, earnings growth seems to be at an all time high. The earnings have more or less doubled in the last 2 years. As a result the valuation do not seem to be stretched. The market is definitely not as richly valued as 2000 or 1992-93. At the same time the earnings growth , return on capital and interest rates are much lower than what we had at that point of time.

At the same time, will it get any better going forward. Can the Return on capital improve further, interest rates fall further and earnings growth improve further ? My thought is that the odds are low ….

But does it mean that one needs to sell or the market is ready for a crash ?? again I don’t think that is likely. I have not been able to come to a definitive conclusion and hence have chosen to do nothing ( not buying and not selling ).

Maybe another 10% increase in the market in the next couple of months could change my mind

Great article from Robert Shiller (of ‘irrational exuberance’ fame)

A great article from Robert J Shiller on china. Just replace china with ‘stock’ of any company and the conclusion reached by Robert makes a lot of sense. The following statement in the article made a lot sense , especially in current context in the Indian market

At times like these, people can easily imagine that an apartment in Shanghai will be worth some enormous amount in 10 or 20 years, when China is vastly more prosperous than it is today. And if it will be worth an enormous amount in 10 or 20 years, then it should be worth a lot today, too, since real interest rates – used to discount future values to today’s values – are still low in China. People are excited, and they are lining up to buy.

To be sure, their reasoning is basically correct. But when the ultimate determinants of values today become so dependent on a distant future that we cannot see clearly, we may not be able to think clearly, either.Since the true value of long-term assets is so hard to estimate, it is human nature to focus on the rate of increase in their observed prices, and to allow one’s attention to become fixated on these assets just as their value is increasing very fast. This can lead people to make serious mistakes, paying more for long-term assets than they should, even assuming that the economy will perform spectacularly well in the future

Is China’s Economy Overheating?

Robert J. Shiller

The Chinese economy has been growing at such a breathtaking annual pace – 9.5% in the year ending in the second quarter of 2005 – that it is the toast of the world, an apparent inspiration for developing countries everywhere. But is China getting too much of a good thing?

Since he became president in 2003, Hu Jintao has repeatedly warned that China’s economy is overheating, and his government has recently acted accordingly, raising interest rates last October, imposing a new tax on home sales in June, and revaluing the Yuan in July.

But claims that China is overheating don’t seem to be based on observations of inflation. While China’s consumer price index rose 5.3% in the year ending in July 2004, this was due primarily to a spike in food prices; both before and since, inflation has been negligible.

Nor are these claims based on the Chinese stock market, which has generally followed a downward path over the past few years.

Instead, those who argue that the Chinese economy is overheating cite the high rate of investment in plant and equipment and real estate, which reached 43% of GDP in 2004. On this view, China has been investing too much, building too many factories, importing too many machines, and constructing too many new homes.

But can an emerging economy invest too much? Doesn’t investment mean improving people’s lives? The more factories and machines a country has, and the more it replaces older factories and machines with more up-to-date models, the more productive its labor force is. The more houses it builds, the better the private lives of its citizens.

A number of studies show that economic growth is linked to investment in machines and factories. In 1992, Bradford DeLong of the University of California at Berkeley and Lawrence Summers, now President of Harvard University, showed in a famous paper that countries with higher investment, especially in equipment, historically have had higher economic growth. One of their examples showed that Japan’s GDP per worker more than tripled relative to Argentina’s from 1960 to 1985, because Japan, unlike Argentina, invested heavily in new machinery and equipment.

In short, the more equipment and infrastructure a country is installing, the more its people have to work with. Moreover, the more a country invests in equipment, the more it learns about the latest technology – and it learns about it in a very effective, “hands-on” way.

It would thus appear that there is nothing wrong with China continuing to buy new equipment, build new factories, and construct new roads and bridges as fast as its can. The faster, the better, so that the billion or so people there who have not yet reached prosperity by world standards can get there within their lifetimes.

And yet any government has to watch that the investment is being made effectively. In China, the widespread euphoria about the economy is reason for concern. Some universal human weaknesses can result in irrational behavior during an economic boom.

Simply put, China’s problem is that its economic growth has been so spectacular that it risks firing people’s imaginations a bit too intensely. At times like these, people can easily imagine that an apartment in Shanghai will be worth some enormous amount in 10 or 20 years, when China is vastly more prosperous than it is today. And if it will be worth an enormous amount in 10 or 20 years, then it should be worth a lot today, too, since real interest rates – used to discount future values to today’s values – are still low in China. People are excited, and they are lining up to buy.

To be sure, their reasoning is basically correct. But when the ultimate determinants of values today become so dependent on a distant future that we cannot see clearly, we may not be able to think clearly, either.Since the true value of long-term assets is so hard to estimate, it is human nature to focus on the rate of increase in their observed prices, and to allow one’s attention to become fixated on these assets just as their value is increasing very fast. This can lead people to make serious mistakes, paying more for long-term assets than they should, even assuming that the economy will perform spectacularly well in the future. They can overextend their finances, fall victim to promotions, invest carelessly in the wrong assets, and direct production into regions and activities on the basis of momentary excitement rather than calculation of economic fundamentals.

So, maybe the word “overheated” is misleading. It might be more accurate to say that public attention is over-focused on some recent price changes, or over-accepting of some high market values. Whatever one calls it, it is a problem.

Fortunately, people also tend to trust their national leaders. For this reason, it is all the more important that the leaders not remain silent when a climate of speculation develops. Silence can be presumed to be tacit acceptance that rapid increases in long-term asset price are warranted. National leaders must speak out, and they must match their words with concrete actions, to help signal to the public that the speculative bubble cannot be expected to continue.

That is what the Chinese government has begun to do. The real-estate boom appears to be cooling. If the government continues to pursue this policy, the salutary effects in terms of public trust in the country’s businesses and institutions will help ensure stable, sustainable economic growth for years to come.

Robert J. Shiller is Professor of Economics at Yale University, Director at Macro Securities Research LLC, and author of Irrational Exuberance and The New Financial Order: Risk in the 21st Century.

Copyright: Project Syndicate, 2005.www.project-syndicate.org

Relationship between PE, ROE and Competitive advantage period (CAP)

I have been working on various permutations of ROE and CAP (period for which the company can earn over cost of capital) using the DCF model to see the PE ratios which are thrown up by the model.

Its fairly intuitive that a company with a high CAP and high ROE should have a high PE. But these permutations have thrown a few insights

- For similar CAP and growth rates a company having an ROE of 20 % should have a PE which is 1.3-1.4 times that of a company with an ROE of 10%. Similar ratios come up for every 10% increase of ROE

- Companies with moderate ROE ( 10-15 %) need CAP of more than 10 years to justify a PE of 20 or higher

- Companies with PE of 30 or higher need a CAP of 10 + years with a growth of 15% and ROE of 25% or higher

So any time I see a company with PE of 20 or higher (which is high these days), the first question I ask is – Given the ROE of the company, does the company have substantial duration of CAP ( 10 years or higher ).

A company with a PE of 30 or higher must have a great return on capital, very strong growth and 10 years or higher CAP. A point worth thinking about when looking at such high valuation companies.

This way of think is detailed in the book ‘expectations investing’ by micheal maubossin and is definitely worth a read.

Downloads, Resource and other major additions to the Blog

I have finally been able to figured out how to provide file downloads from my blog (via yahoo briefcase).

I have a substantial reading material on buffett, Munger, Graham and other investing greats. I have initiated uploading this material under the various sections on the sidebar. Please look under ‘buffett resources’ today for some additional material. I will be continously loading additional material going forward

So stay tuned and hope you enjoy reading the uploaded material.

Please feel free to share thoughts, comments, views and suggestions on how i can improve it my blog further

An update on Pidilite industries

Pidilite declared a 1:10 split recently. The stock market reacted favorably and has bid the shares to 93 (930 pre-split). The split is hardly a value creation event. Just divides the cake (or pizza if you like the analogy) into more slices. Really does not enlarge the cake. So the company now sells at a PE of 26. Definitely not undervalued …I would say overvalued or at best fairly valued

Time to look at selling the stock ?? I think so ….

A Few thoughts on indian retail industry

I was going through a report on the Retail industry specifically the Lifestyle / Garment (Non – Food sector).

I was going through a report on the Retail industry specifically the Lifestyle / Garment (Non – Food sector).

Key points and my thoughts

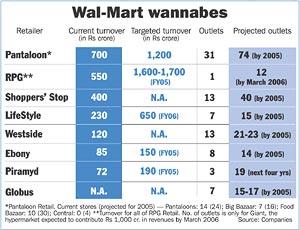

· There are about three main publicly listed companies – Pantaloon, Trent, and Shopper’s stop

· All companies showing rapid growth (50 %+) and expected to show it for the next 2-3 (or more) years due to new stores being opened and share of organized retail rising ( current 3-4 % may go up to 7-8 %)

· All companies have raised debt or equity to fund expansion . In addition all the three do not have excessive debt and should be able to grow easily

· Margins are competitive ( 7-10 % OPM) and Net margins in the 3-4 %. For companies which have higher % of in-store brand , the margins are higher.

· New formats coming up such as central from Pantaloon ( A form of Superstore), Big bazaar (For groceries etc ) which have been fairly successful. Other companies in the space are also expanding through similar formats ( Trent has launched its hypermarket – Star India bazaar )

Positives

Strong growth in the sector due demographic changes in India ( Young middle class is now shopping more in such places)

A few successful formats are coming up which are driving growth

Development of organized retail will improve / streamline supply chain and help in developing the sector further

Negatives

· Competitive advantages depend on economies of scale / Brand and location advantages. Companies like Pantaloon if they can achieve scale would be able derive these advantages and face foreign competition. Companies which do not scale up or develop a niche will have a tough time facing foreign competition

· Foreign competition – Walmart / Carrefour are expected to enter the market. Their huge expertise and deep pockets cannot be matched by Indian players. Also reliance and other large industrial houses may enter the sector (Will the existing players get wiped out or relegated to niches ?)

· Valuation – Currently all the companies are trading at PE of 40-50 which reflect the opportunities ahead. But somehow the market is not considering the risks to these companies from expected competition

An important sector to follow, but not worth investing now as there is no margin of safety in the valuations (which reflect great times ahead, but no risks at all)

A Go/No Go decision

I was reading an interview (or maybe annual meeting transcript) of warren buffet sometime back and he was asked about the discount rate he uses in the DCF (discounted cash flow) calculations.

He indicated that he uses the long term treasury risk free rate. In addition, for him a decision to buy is really a go/No go decision. If he can understand the company, its economics and predict its future for 10 years or more, and if the value is screaming at him, he goes ahead. Otherwise he passes.

I have changed my decision process after reading the above comment because it makes sense for a small investor like me. If I can understand the economics of a company (which rules out a huge number as my circle of competence is small) and if the decision is a slam dunk , I go ahead and commit my money. Else I pass. Now that has resulted in my leaving a lot of companies which were close and later did very well in terms of stock price. But in the end I would rather be sure of my decision than tweak my DCF model, fiddle with my discount rate and build hypothetical assumptions of good growth and at the first downward blip , not have the confidence to hold on to the stock.

The above go/No go approach has resulted in my leaving out pharma companies, a lot of commodity companies etc. But then for a retail investor like me who needs a few good ideas a year and does not have to show a quarterly performance like a fund manager, why take the risk and the heart burn ?

Cannot find much to invest in these days

Cannot find much to invest !! I typically run screens provided by icicidirect. Most of the companies being thrown up below a PE of 10-11 (I keep a cutoff at 10-11 as I think that would be the approximate value of a company with no growth and returns at cost of capital. So any company having growth and a ROC of greater than Cost of capital would be worth more).

Sample of some companies which came up

– EID parry: In commodity industry (sugar etc) and selling at 16 times peak earning (the screen was wrong and did not consider the 1:5 split.

– Banks: Several banks like Karnataka bank etc came up. Need to check if any banks would have value

– Tata steel, Essar steel, Gujarat ambuja cements – Commodity companies selling in low teens of Peak earnings. Would not be looking at investing at peak / uptrend of business cycle. Also PE is generally a poor indicator for cyclical companies. Generally during downtrends these companies would sport a high PE on depressed earnings and that could be a good time to invest.

– UB holding – A Loss making holding company selling at a CAP of 1100 crores. Tangible assets appear in the range of 300-400 crores. They could have some undervalued assets on balance sheet such as land holdings at cost, Investments in subsidiary companies. Looks unlikely to be worth more than 800-900 crores. I will need to look closely.

Any good ideas ??

How VOIP could impact telecom industry – part 2

I recently posted my take on an article published in the economist about how VOIP could disrupt the traditional telecom model.

A few days later e-bay bought out skype (a VOIP service which allows users to make calls from their computers to any one in the world for free – and also to regular phone , but for free).

There is a great article on this deal in the economist – The meaning of free speech .

A snippet from the article below

His vision for Skype, by contrast, is to become the world’s biggest and best platform for all communications—text, voice or video—from any internet-connected device, whether a computer or a mobile phone.

This is every bit as audacious as it sounds. Mr Zennstrom, in general, is a modest man. But his company is only three years old, will probably make only $60m in revenues this year, and will certainly not turn a profit. So it is the fact that his ambition is not nearly as ridiculous as it sounds that should make incumbent telecoms firms everywhere break out in a cold sweat.

That is because Skype can add 150,000 users a day (its current rate) without spending anything on new equipment (users “bring” their own computers and internet connections) or marketing (users invite each other). With no marginal cost, Skype can thus afford to maximise the number of its users, knowing that if only some of them start buying its fee-based services—such as SkypeOut, SkypeIn and voicemail—Skype will make money. This adds up to a very unusual business plan.

“We want to make as little money as possible per user,” says Mr Zennstrom, because “we don’t have any cost per user, but we want a lot of them.” This is the exact opposite of the traditional business model in the telecoms industry, which is based on maximising the average revenue per user, or ARPU. And that has only one logical consequence. According to Rich Tehrani, the founder of Internet Telephony, a magazine devoted to the subject, Skype and services like it are leading inexorably to a future in which all voice communication, near or far, will be free.

And more –

Even before VOIP makes 100% of telephone calls in the world completely free (which may take many years), it utterly ruins the pricing models of the telecoms industry. Factors such as the distance between the callers or the duration of a call, the key determinants of cost today, are simply irrelevant with VOIP. Vonage already lets its customers choose telephone numbers in San Francisco, New York or London, no matter where they live. A Londoner calling the London number is making a “local” call, even if the Vonage subscriber is picking up the phone in Shanghai. As when checking e-mail on, say, Hotmail, the only thing needed is a broadband-internet connection, but it can be anywhere in the world. Sooner or later, people will discard their unwieldy phone numbers altogether and use names, just as they do with their e-mail addresses, predicts Mr Zennstrom.

Call duration is also becoming irrelevant. “A lot of people open a Skype audio channel and keep it open,” says Mr Zennstrom. After all, it costs nothing. Many people with Apple computers are already accustomed to this. They open an application called iChat, which is a video and voice link, and stay connected to their loved ones far away. Increasingly, members of a family or a business team can stay online throughout the day, escalating from unobtrusive instant-messaging (“Can you talk?”) to a conference call, a video call and back to a little icon on their screen.

It is thus altogether wrong to call this phenomenon the end, or death, of telephony. “Calling it the death of telephony suggests people aren’t going to make calls, but they are,” says Sam Paltridge, a telecoms guru at the OECD. “It’s just the death of the traditional pricing models.” In short, all this is great news for consumers and awful news for telecoms operators. “VOIP will destroy voice revenues faster than most analysts’ models predict,” says Cyrus Mewawalla, an analyst at Westhall Capital. “Voice will very rapidly cease to become a major revenue generator for all telecoms operators, fixed and mobile.”

This is likely to hit the indian telecom providers hard. Somehow the valuation of these companies does not seem to be reflecting that. Its possible that it is early days for this technology in india ( we barely have phones , much less internet and broadband ). But i think it will eventually hit the indian telecom providers too ( maybe starting with the international calls where the margins are higher ).