In an earlierpost, I wrote about the two types of risks faced by an investor – risks faced by all investors irrespective of the nature of the investment and business risks associated with a particular investment.

In this post, I will try to describe a variety of business risks and how I use it via a checklists to further evaluate a business. The list I present below is by no means comprehensive (as I am not writing an academic paper) and just represent the ones I have faced in the past or can think of as I write this post.

Advance warning – this is a long post even if it is not comprehensive and there is no silver bullet or blue/red pill at the end to make investing easier.

Regulatory risk [earning excess returns from favorable regulations]

If a company is able to make above average profits due to a favorable regulation, then it is exposed to this risk. For example, think of a banking license or the right to supply natural gas to a specific geography such as Delhi in the case of indraprastha gas.

In these cases, the company has a pseudo monopoly due to a favorable regulatory position. If the terms of the regulation changes, the company could find that the economics of the business has worsened or worse, it no longer has a viable business at all.

There are a lot of examples of this kind of risk. For example, PNGRB – the gas regulator announced in april 2012 that they had the authority to fix gas prices and asked IGL to drop its price by 50%+. The company lost more than 50% of its value after the day of the announcement and since then has recovered most of it, after the supreme court overturned the decision. In spite of the favorable response, an investor in this stock has done worse than the index during the same time period.

The same story has played out for several companies in the mining space after the Supreme court order banning iron ore mining due to the illegal mining problem in some states. This kind of risk is critical in the case of telecom, power, finance and other heavily regulated industries.

The key point is this – If the business model of a company depends on specific regulations, then the company is always exposed to this kind of risk. . The company could be doing well for a long time and then suddenly the regulator or the government can change its mind and put the entire business at risk.

I have noticed that the market is usually sanguine about this risk and it is generally not priced in. However if the risk materializes, the reaction is swift and brutal. The only way to mitigate this risk is either to avoid such companies altogether or hope and pray that the regulator/ government does not change its mind on the key regulation.

Reputation risk [earning excess returns based on reputation/ brands ]

This is a key risk in those businesses which depend on the reputation of a brand or a company. If the company earns an above average profit due to a favorable image or brand position, then it is very important for the company to safeguard the brand.

In the event that there is some incident where the brand image is impacted, the management should react swiftly and prevent further damage to it.

Case in point – Maggi from nestle. Irrespective of the merits of the case, the response of the company to the whole lead content issue and subsequent recall was appalling. The issue surfaced in April and the company finally responded in June when the issue blew up in the media. This is a 1.2 Bn dollar brand and the management did not react to the situation till it finally got out of hand. Net result – The company lost close 20% of its market cap in the aftermath.

This risk is critical when the company you invest makes money based on the power of its brand and trust. The only way to mitigate this risk is to have a management which reacts promptly if it sees a risk to the reputation of the company or its brands.

Management risk [Poor quality management]

This is a risk commonly understood, accepted but least followed by a lot of investors. If you talk to someone who has been investing in the markets for a period of time, they will agree that it is important to invest only with a high quality management.

Lets first define what is high quality which I like to think of on two parameters

Capital allocation and distribution – does the management allocate capital at high rate of return in the business and distribute the excess to shareholders via dividends?

Ethical behavior towards all stakeholders – Does the management behave ethically or treat other stake holders (such as customers, employees, shareholders etc) in a manner they would like to be treated if the roles were reversed?

The first parameter is quite objective in a nature and can easily be verified by looking at the return on capital of the business over an entire business cycle. It is amazing to find that people end up investing with managements which have consistently destroyed wealth (several airlines come to mind). I understand that at a certain price, even a value destroying business can give good returns, but a majority of the investors end up buying such companies at the peak of a cycle when the profitability seems to be high (but is just a mirage)

The second factor is far more difficult to evaluate and needs careful study of the management’s actions over time. Again it is not easy to define the right behavior in several cases such as high compensation or bending regulations to gain an undue advantage in business.

Even if we leave aside some of the fuzzy stuff, it is quite easy in a lot of cases to just reject a company if several red flags pop up. In the end, my own experience has been that if you ignore this risk, it eventually catches up. A particular investment with unethical and incompetent management may not go south, but over time the law of averages work and the overall result will be poor.

The only way to mitigate this risk to avoid such companies and management. It will prevent a lot of anxiety, heartburn and sleepless nights

Customer concentration risk [All eggs in one or few baskets]

This risk arises when a company derives a large percentage of its revenue from a handful of customers. Although this is an easy to understand risk, it not necessarily as easy to evaluate.

For example, is it better for IT and other service companies to focus on their top customers who provide 80% of their revenue instead of spreading themselves thin? I don’t have an answer to this question.

There is one crucial factor to consider when thinking of this risk – Customer lock-in. If a customer is locked in with a company and cannot easily switch then it makes sense to devote enough resource to maintain this competitive advantage.

However if a customer can easily switch suppliers based on price, then customer concentration will kill a business. A company fighting price based competition and earning its revenue from a limited set of customers is never going to earn profits above its cost of capital and is likely to remain locked in a low return business.

This risk turns up in surprising places. China as a country is the largest consumer of most commodities such as steel. So when this ‘customer’ slowed, the price of the product collapsed and has hurt all suppliers in the product category. It does not matter if as a steel company you don’t supply to the Chinese market. Once the no.1 customer in the steel industry (accounting for 50%+ of global demand) slowed, everyone in the industry was going to get hurt.

There is no easy way to mitigate this risk and it requires a case to case decision. One needs to be aware of the level of concentration for the company and check if the management is focused on either reducing the concentration or has such as hold on the key customers, that it will not be exposed to price based competition.

Competitive risk

The easiest way to think about this risk is to count the number of companies in an industry and tabulate their market share. If you find just one company and that company has a 100% share, then you have found a monopoly with no competitive risk.

At the other extreme if you start listing the companies and end up with a long list of firms with each company having a tiny share of the market, then you are looking at an industry with high competition and poor returns.

I have generally used a simple thumb rule to evaluate this risk. If the top 3-5 companies account for 60%+ of an industry and most of them earn over 15% return on capital, then the competitive intensity within the industry is low. On the other hand, if I have to spend over a week finding all the companies in an industry and if the top 10 companies account for less than 50% share (assuming I can even get this number), then it is very likely I have stumbled into an industry with high levels of competition and poor profitability.

For example – most consumer brands have limited numbers of companies and high profitability. On the other hand, industries such as cement, textiles etc are the other end of the spectrum with a large number of companies and poor profitability.

As an investor, you can manage this risk by first diversifying across industries so that a sudden worsening of the economics in a particular industry will not sink the entire portfolio. The second way to manage this risk is to study each company and its competitive position in detail so that you are atleast aware of the risks and do not get blindsided by it. Finally, as an investor one is paid to understand and manage this risk.

Change or obsolescence risk

This risk is especially relevant in fast moving industries where the underlying technologies are going through a lot of change. Think of telecommunications – this is a fast paced industry which needs a lot of investment, but at the same time the underlying technology keeps changing rapidly (see my post herea long time back on the same topic).

We have seen the technology go from 2G to 3G to 4G to who knows what ( 5G is already being tested in labs and can do 1 gbps ). There is wifi, satellite or balloon internet and all sorts of communication tech coming up. Is it easy to predict what will be the shape of this industry in 2020? Doing a DCF analysis and putting a terminal multiple on the valuation of a telecom or similar company is sheer insanity.

The way to mitigate this risk is to have a very deep understanding of the particular industry, monitor the changes closely and not overpay for the stock. However if you do not have any specialized understanding of such an industry, it is best to stay away – discretion is often the better part of valor in investing

Commodity risk

This is the case where the price of a specific commodity drives the profitability of the business. This is obvious in the case of industries such as steel, metal, oil etc.

It was not so obvious in some other cases, till the commodity price dropped and hurt the industry badly. Take the example of jewelry/ gold loan companies.

These companies became the darling of the markets in the 2010-2012 period when the price of gold was going through the roof. A lot of these companies got a double boost from rising demand (due to rising gold prices) and from an increase in the value of their inventory.

Once the tide turned, some of these companies have struggled to remain profitable.

A similar story has played out in the agri space for seed companies (where the price of commodities have dropped) or mining firms.

One way to mitigate this risk is to evaluate a company over the entire business cycle and see if the company is merely the beneficiary of a lucky tailwind from rising commodity prices or will do well inspite of the commodity prices.

Capital structure risk

A company having a high debt equity ratio is generally a riskier company. What is ignored sometimes when evaluating this risk are the hidden liabilities which are the equivalent of debt, even though they do not appear as such on the balance sheet.

Take the example of tata steel and its pension liabilities or airplane lease and other fixed costs in case of airlines, which are a form of quasi debt.

The deadly combination is when some other form of business risk hits a highly indebted company. In such cases, the end result is often bankruptcy (atleast for the minority shareholders in india, promoters have no such risks)

How do you mitigate this risk? Learn to read the balance sheet carefully and understand all forms of fixed obligations which cannot be reduced even if the revenue goes down. Try to answer the question – How long will the company survive if its revenue dropped by 20%.

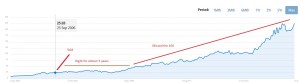

Valuation risk/ growth risk

This not a risk of the business risk. If you pay for the growth and it does not happen, then you are in trouble. An example which comes to mind is Hawkins cooker. A lot of investors continued to give high valuations to the company even when the growth slowed.

However once reality hit the market, the reaction was swift and sudden. As much as investors curse the management after such an event, I do not blame them for it. One can fault the management on not doing its best to deliver the highest possible growth, but then if growth is not visible, nothing stops an investor from exiting the stock for better opportunities.

There are several other companies (Which I will not name) which seem to be in a similar place – low growth, but high valuations. If we are lucky the drop in the multiple would be slow and gradual unless the growth picks up and justifies the valuations.

How do you mitigate this risk – simple, don’t follow the herd and think for yourself. If you don’t understand why a company sells for a high valuation, move on. Investing is not an exam paper where you have to answer all the questions to pass!

How to think about risks

Are you still reading? congrats !! you are true fan of this blog and also like to read boring stuff on investing J

It is easy to go on and on about risks and there are books on each type of risk. I cannot do justice to all of them in a single post. As an investor one has to evaluate all of these risk and more for each investment idea and identify which ones are the most critical.

Let me give an example – I used to hold Noida toll bridge company earlier in my portfolio . As I started thinking of the risks associated with the company, there were two key ones I was able to identify

– Reinvestment risk: The company had been generating a good level of free cash flow, but had no opportunity to re-invest it. A company which cannot re-invest its cash flows is equivalent to a long dated bond and will get valued as such. Hence in this case, once the company reached its steady state cash flow, the future returns were likely to follow the growth in cash flow which was expected to be in the range of 6-8%.

– Regulatory risk: The Noida toll bridge is a BOT project with an assured 20% return during the operation period (around 30 years). On top of that if the company did not make these returns in any year, the company could just carry forward the shortfall to the subsequent years. This meant that by 2011-12 the company had close 2000 Crs+ of shortfall on its books. The ground reality was that the Noida authority had refused to raise the tolls even by the level of inflation and every time they did, there were protests and dharnas. So the chance of realizing this shortfall was low.

The key point in the above idea was that the upside was limited and there was a regulatory risk which if it materialized, could completely destroy the investment thesis. So in a stroke of brilliance, after having held the stock for 2+ years and with a minimal gain, I decided to wise up and exited the company.

In July 2015, the management announced that company was re-writing the contract which would now end by 2031 and its likely the company will not be able to recover the prior shortfall. The stock dropped promptly as the market had assumed that company would be able to make up some part of this shortfall by an extension in the lease term or land development rights.

The above case is instructive of a variety of business risks. A lot of business risks are fuzzy and grey and one cannot put a precise number behind it. In addition, these risks do not materialize for a long time. However if one does materialize, the stock market is quite efficient in resetting the valuations promptly.

As an investor, you can ignore business risks at your own peril.

No mathematical precision

You would have noticed that I have not used any greek letters or volatility measures till now to measure the business risk. It should be quite obvious that these academic measures do not represent the risks for a company.

Think of the example of Noida toll bridge – did the past volatility of the company give any indication of the regulatory risk faced by the company?

The best one can do is to be aware and analyze these risks on an ongoing basis. If you are being compensated to bear this risk (in the form of expected returns), then you continue to hold the stock. If the returns are inadequate or if you think the downside from the risk will be too severe, then the best option is to sell and move on

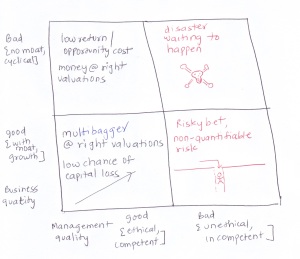

My current approach to evaluating the risk is usually as follows

– I have a checklist of all the above risks and use it to evaluate which of these risks are relevant for the company I am analyzing.

– I try to dig deeper into the critical risks for the company and understand what are the key drivers and how it could hurt the company and its valuation

– My job as an investor is to evaluate the upside from the bull case of the company versus the downside from all the risks facing the company. If the downside risk seems too high, I will just move on to the next idea.

One final point – if this sounds complicated and difficult to implement, let me assure you – it is and will always be. The upside is that with an increase in competition for investment returns, this may still be an area where a hardworking and diligent investor will continue to have an edge over others.

—————-

Stocks discussed in this post are for educational purpose only and not recommendations to buy or sell. Please contact a certified investment adviser for your investment decisions. Please read disclaimer towards the end of blog.