There was an error in the analysis of crisil in the post . I had looked at the standalone numbers only and not the consolidated numbers (as an anonymous reader has pointed out in the comments)

So crisil may not be a good example of over valuation. I am not sure how undervalued the company is. It sells at a PE of 33 (approximate Net profit of 100 odd crs for 2007). I have analysed the company earlier here …and I have underestimated the competitive advantage of this company and its ability to keep increasing its instrinsic value.

That said, if I were make my point in the post again, I would replace crisil with any of the Real estate companies or capital goods company which have a high performance hurdle to cross (due to their high PE) to deliver good returns to investors in the future.

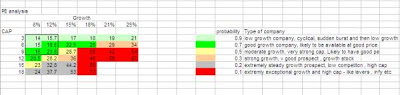

The post was however was not an analysis of CRISL. The key point is this – A good company may not be a good stock and vice versa (important word is ‘may’) . That depends on whether the stock price fully discounts the future performance of the company or not. If one has to make money in such high PE stocks, then the actual performance has to be better than what is implied by the stock

Low PE or low valuation stocks have low expectations built in and hence a small improvement in the company performance can deliver good returns. High PE or stocks selling at high valuations are stars of the Stock market. If they stumble even a bit, the stock price can get butchered. So one has to be confident and sure that the company will meet the high expectations well into the distant future.

I have personal experience of seeing a stock drop 90% when the company was not able to meet its high expectations (see here).

Ofcourse you can say that I am not as dumb as rohit and will not make a mistake like him 🙂

Feb 23 :

Following quote from peter lynch is very relevant to the topic of this post

“It’s a real tragedy when you buy a stock that’s overpriced; the company is a big success and you still don’t make any money.” Peter Lynch, “One Up on Wall Street,” New York, Penguin Books, 1989, p. 244.

I am a big fan of Mohnish Pabrai. He is a very succesful investment manager and has recently written a great book – dhandho investor.

Following article from mohnish explains the key point of the post – A good company may not be a good stock and vice versa in a great (and much better) way.

Valuation by intrinsic value.

In addition you can find the links for a lot of mohnish’s articles here. I strongly recommend reading each article