It was the later part of March 2020 and I was really worried about the tail risks to our portfolio. I started getting worried about Covid in late feb/early march and wrote the following posts on it

And the key post in the series: Economic sudden stop in which I wrote the following

What is an economic sudden stop – It is when most economics activities for a location come to a sudden stop due to a financial or natural disaster. In most cases such sudden stops are local such as due to a flood or an earthquake.

Global sudden stops are extremely rare and have happened only during the great depression in 1930s and 2008. Even during wars, we do not have such a situation.

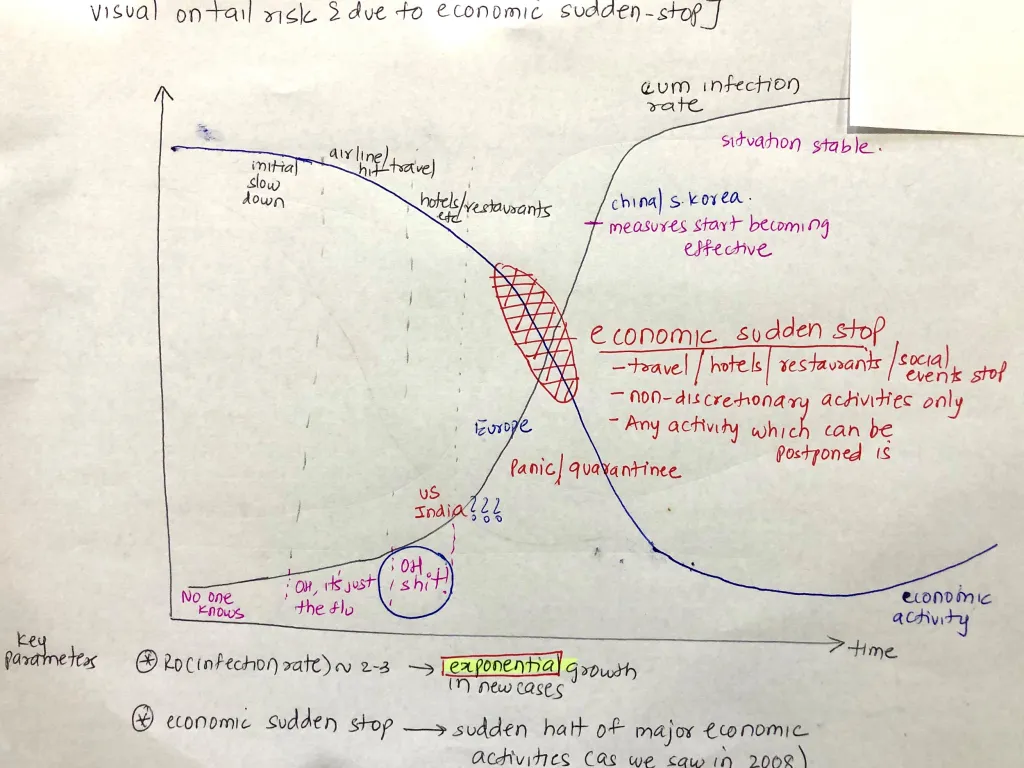

The current crises has the potential of an economic sudden stop (and may have started). I have been thinking of this risk (which I have been referred to as a Tail risk). Over the weekend, I drew the following crude picture to illustrate my hypothesis (please excuse my drawing)

In view of this risk, I decided to analyze all my positions for bankruptcy risk. I wanted to assess how long the companies in my portfolio would survive, if there was complete stoppage of business (revenue = 0)

I am attaching the analysis below. Please note all companies in the note are for educational purpose only. Also we don’t hold these stocks now.