Following is from a note published to subscribers. Hope you find it useful

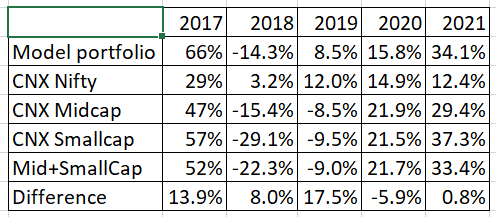

It may appear that our outperformance is from how well we do in an upcycle. That is not entirely true. let me share some stats

Losing less than the indices

I have no preference for any particular market cap but tend to avoid the smallest companies from a risk and liquidity standpoint. Outside of that, any company is fair game for our portfolio

If you look at the table above, one period of outperformance stands out. In 2018 and 2019, when the market went south, we lost much lesser than the market

We were outperforming when it did not appear that way. Losing less than the market in bear markets is also an achievement, even though it may not appear to be. Some of the subscribers who joined us during this period, threw in the towel before the market turned as they did not agree with that notion.

The period of 2018-2020 was not an easy one. I made some of the worst mistakes of my investing career – Shemaroo, Edelwiess Financial services and Thomas cook (sat on it for too long). These losses are seared into my memory. When you lose your own money and that of your family, it is not easy to forget

In spite of these mistakes, we lost much lesser than the indices. The key was to keep our heads down, keep working and wait for the tide to turn. It was also important to have some extra cash in place

Regular theme

The last few years are NOT an aberration. This has occurred regularly, and it will occur again. You can take the following as a given

- We will lose money from time to time, at individual stock and portfolio level, even though I am focused on not losing money, which includes my own

- There will be long stretches of underperformance with sudden spurts of outperformance

- Returns will be lumpy and unpredictable

- If you do not have the patience to stick around, you may exit at the wrong time

Let me share another metric to underscore my point

The model portfolio is up around 50% from 15th Jan 2018 to 30 Jun 2021. What is special about these two dates? The small cap index peaked on first and then went into downturn. It regained this peak again this year.

We are up 50% from peak to peak

The key is to evaluate performance is to do it over a cycle and not from the bottom to the top of a cycle (when everyone looks like a genius) or from top of a cycle to the bottom, when any outperformance is hidden