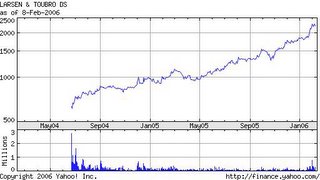

My decision to sell L&T in 2003 (after holding for 4 years) has been my worst investment decision till date. Although my cost basis was 190 odd (pre-divesture) and I sold at 230 odd (again pre-divesture) and did not lose money on it, I consider it to be one of my worst decisions because of the following reasons

- The stock has since then become a 10 bagger (sells at around 2250 without considering the value of cemex)

- I sold off because I became exasparated with the management. Between 2001 and 2003, they would constantly pay lip service to divesting the cement division and would then drag their feet on it. What I failed to realise at that time was that the Kumarmangalam birla group would be able to force the management to divest the business eventually.

- Did not appreciate the importance of the business cycle. The E&C sector was in doldrums at that time and as a result L&T (E&C) division profits were depressed. The E&C sector turned around big time after 2003 and every E&C company has benefited since then

- Did not do the sum of parts analysis – basically that the sum of value of the various L&T divisions was more than the complete entity.

In the end, my regret is not that I missed a 10 bagger. What clearly pricks me is that my analysis was sloppy and I did not evaluate all the factors clearly. I was looking at the company with a rear mirror view (the Margins and the ROE were poor then and I expected it to continue).

However, I have tried to learn something from this disaster. So here goes

- understand the sector dynamics when investing in a stock.

- Appreciate the importance of business cycle. Although predicting it is not critical, but a basic understanding is a must.

- Focus on sum of parts versus looking at a company as a whole, especially if the company has various different businesses.

- Have patience

- Try to avoid a rear mirror view.

Have you had such an experience?

Isn’t the main lesson to be learnt here is that the questions we pose to assess the management was incorrect?

i still believe that the L&T management is not really shareholder friendly …after the demerger they awarded themselves almost 10 % (not sure of the no.) of the company. they had a scheme by which the employees were allocated almost 10% of the company equity (through some arrangement which i do not remember).you should have seen the kind of diversifications the management did in the late 90’s and the shareholder value they destroyed.however i definitely assessed the other factors incorrectly and paid the price for it (a huge opportunity cost)

Hi Rohit,Im sure, you’ll feel better when you hear this one … I bought BEML at 107 rupees, sold two days later at 144 rupees. Today’s CMP is 1510 rupees. Thats a 15-bagger :-)Shit happen !!! … that’s why I crudely call it “tution fees”Warm RegardsShankarsmall2big.blogspot.com